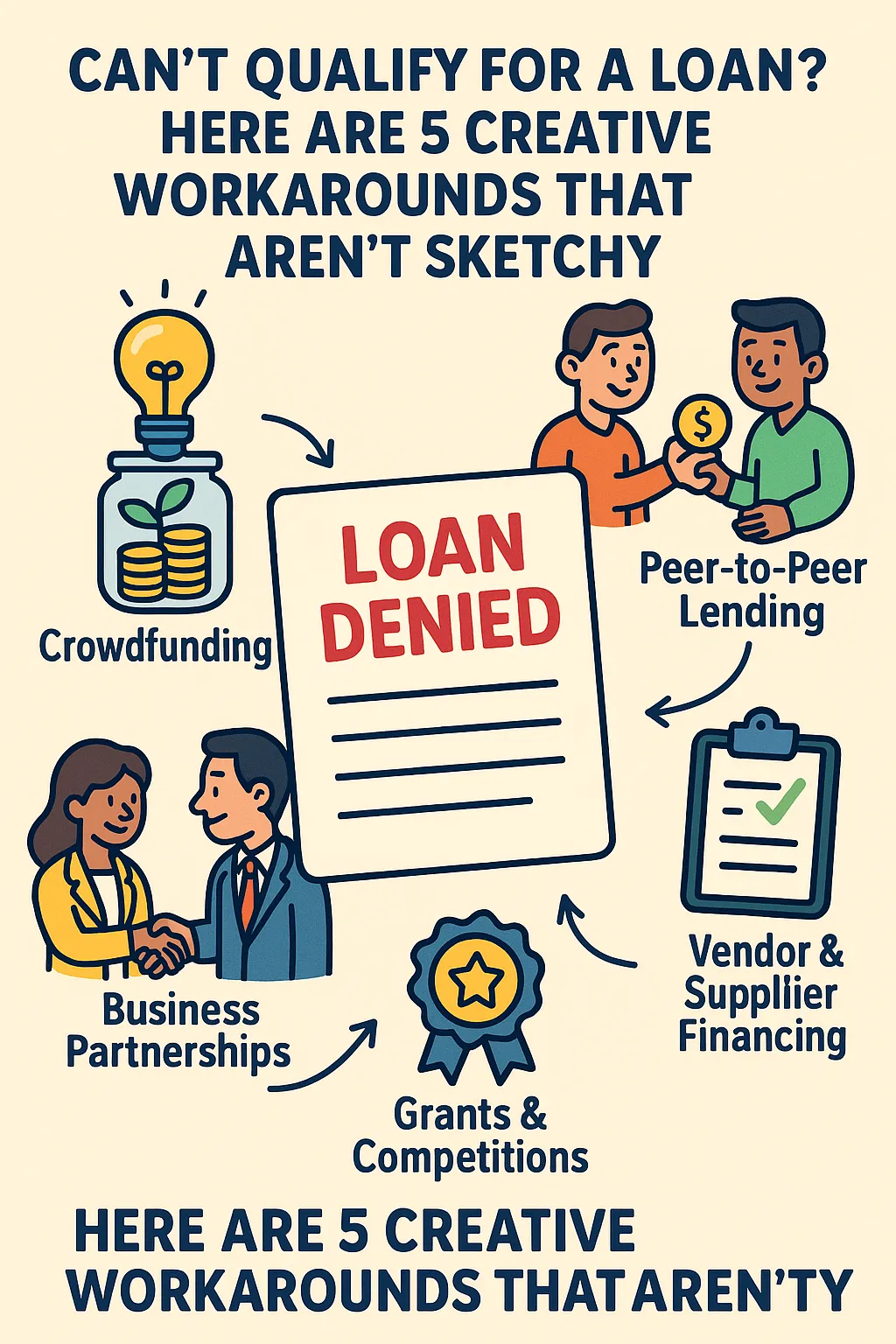

Can’t Qualify for a Loan? Here Are 5 Creative Workarounds That Aren’t Sketchy

Getting denied for a loan feels like a punch in the gut—but it’s not the end of the road. Here are five creative, totally legit alternatives to keep your business moving forward.

😬 The Problem: Loan Denied. Now What?

We’ve all been there. You apply for a loan, cross your fingers, and instead of an approval email, you get that dreaded “We regret to inform you…” message. Ouch.

But here’s the good news: loans aren’t your only option. There are plenty of ways to fund your business that don’t involve sketchy loan sharks or maxing out five credit cards.

Let’s talk creative, safe, and totally above-board solutions.

💡 1. Crowdfunding (a.k.a. The People’s Loan)

Why let one bank decide your fate when a crowd of strangers on the internet could chip in?

Platforms like Kickstarter, GoFundMe, or Indiegogo let you raise funds by sharing your vision.

Bonus: You’re also building a loyal fan base before your product even launches.

👭 2. Peer-to-Peer Lending (aka Borrowing Without the Suits)

Sites like LendingClub or Prosper match you with individual investors instead of traditional banks.

Often more flexible than banks.

Sometimes faster approvals.

Still regulated, still legit—no parking lot handshake deals required.

🤝 3. Business Partnerships (Two Wallets Are Better Than One)

Can’t qualify solo? Bring in a business partner who can:

They may have the credit or assets you don’t.

In exchange, they share in the business’s success (and risk).

Think of it as dating with joint bank accounts—just make sure you trust each other.

💳 4. Vendor & Supplier Financing (Because Who Needs Cash Upfront?)

Some suppliers will let you buy now and pay later, giving you extra time to generate revenue before bills come due.

Example: Net-30 or Net-60 payment terms.

Translation: More time = less stress.

This is like convincing your landlord to chill for a couple of months while you “figure it out.”

🏦 5. Grants & Competitions (Free Money, No Strings Attached)

Okay, so free money does exist—you just have to know where to look.

Government small business grants.

Nonprofits supporting minority-, women-, or veteran-owned businesses.

Pitch competitions where winners get funding.

The best part? Unlike loans, you don’t have to pay it back. 🎉

🎯 Final Thoughts: Get Creative, Stay Legit

Not qualifying for a loan isn’t the end of your business dreams—it’s just a nudge to think outside the bank. From crowdfunding to partnerships, there are legit ways to get the capital you need without sketchy shortcuts.

Because your business deserves more than a “sorry, not this time.”

💼 Looking for smart funding strategies (loans and alternatives)?

👉 www.oracleconsults.com – Let’s get your business funded the right way.