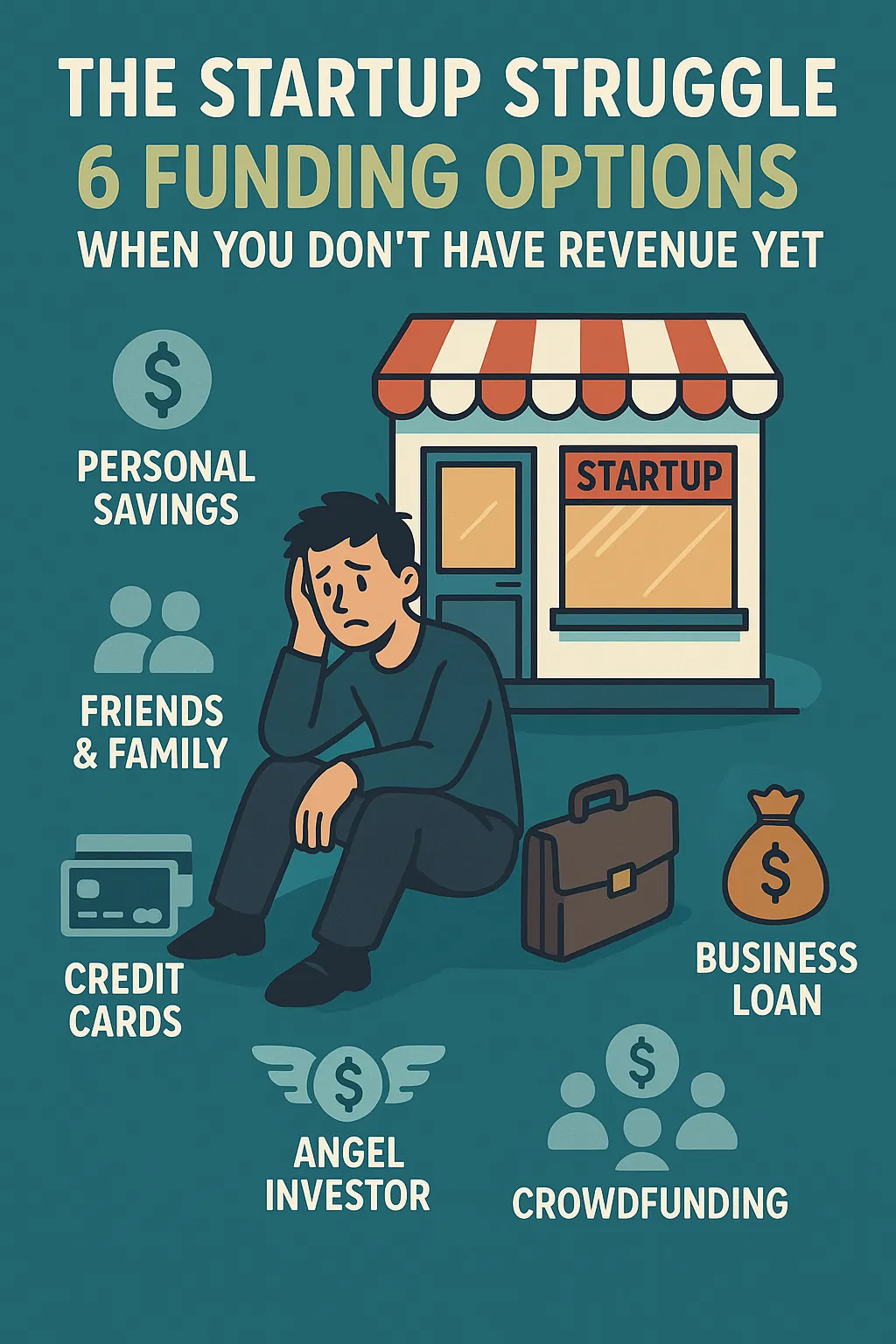

The Startup Struggle: 6 Funding Options When You Don’t Have Revenue Yet

Starting a business is exciting—but also expensive. Between equipment, marketing, inventory, and operations, the bills stack up quickly. And here’s the catch: most lenders want to see revenue before they approve you for funding.

So what do you do when you’re just getting started and the numbers aren’t rolling in yet? The good news: you still have options. Here are six legitimate ways to fund your startup—even if you don’t have revenue (yet).

💳 1. Personal Credit-Based Business Funding

When your business hasn’t built a financial history, lenders look at your credit instead. Options like unsecured business credit cards or personal credit-based loans can provide quick startup capital, with approvals often based on a FICO score of 650+.

👫 2. Friends & Family Contributions

It may not be glamorous, but many of the biggest companies in the world started with small checks from family or friends. Keep it professional: write out terms, agree on repayment (or equity), and treat them like investors.

🌐 3. Crowdfunding Platforms

Websites like Kickstarter, Indiegogo, and GoFundMe let you raise money from everyday supporters who believe in your idea. Bonus: you’re not only raising capital, but also building an early customer base.

🛠 4. Equipment or Vendor Financing

If you need tools, supplies, or inventory, some vendors and suppliers will extend financing—letting you “buy now, pay later.” This helps free up your limited cash for marketing and operations.

🏦 5. SBA Microloans

Through community lenders and nonprofits, the Small Business Administration provides loans up to $50,000 that don’t require years of revenue. These loans are designed to help new entrepreneurs get off the ground.

🤝 6. Partner with a Funding Network

Instead of trying to knock on every lender’s door yourself, partner with a referral network like Oracle Consulting. We specialize in matching startups with lenders who are open to working with businesses that are just getting started. One simple application gives you access to multiple options.

🎯 Final Thoughts: You’re Not Stuck

Having no revenue doesn’t mean your funding journey is over—it just means you need to think creatively. Whether it’s personal credit, crowdfunding, or SBA microloans, there are ways to get moving without waiting years to “look good on paper.”

👉 Ready to explore startup funding? Visit oracleconsults.com or call (833) 432-6740 today and see what you qualify for.